There is comfort in homeownership – but there’s also some uncertainty. When a major system fails or there is a breakdown of a major appliance, the repairs can also add up quickly to thousands of dollars. That’s why the 2-10 home warranty is important. It’s a service contract that protects homeowners from the financial responsibility of unexpected mechanical failures, offering repair or replacement coverage of items that wear out over time.

But don’t think this warranty is only for unforeseen breakdowns. For anyone purchasing, selling, or managing a home, it’s also a preventative resource. No matter if you’re responsible for repairing HVAC units, washing machines, refrigerators, stoves, or other systems, it’s nearly impossible to predict when they will fail. And so there are ways to alleviate the stress, limit the expense, and find reliable contractors when things go wrong. So whether you’re moving into a new build or trying to extend the life of your older systems, the more you understand about how the warranty operates – and how to operate with it – the better you’ll be able to protect your largest asset.

What Does a 2-10 Home Warranty Cover?

Like choice home warranty 24/7 the 2-10 warranty offers comprehensive protection for your home’s main appliances and systems. There are two primary components to it:

Systems Coverage: This refers to your HVAC systems, which include heating and air conditioning. Generally, if your furnace or air conditioning system fails because of normal wear and tear, you would be covered for repairs and replacements. Electrical wiring, the circuit panel, and the interior plumbing system (which includes your water heater, leaks, and stoppages) are also covered with systems commitments.

Appliance Coverage: Appliances such as dishwashers, built-in microwaves, ranges, refrigerators, and garbage disposals are generally provided with coverage in standard plans.

Some plans will also provide optional coverage, such as well pump coverage, roof leak coverage, septic coverage, and even a secondary refrigerator. Optional coverage can be very useful or helpful if you either have a larger or older home.

How does the 2-10 home warranty work?

The 2-10 warranty follows a systematic and predictable process that’s designed to minimize the stress of emergency repairs:

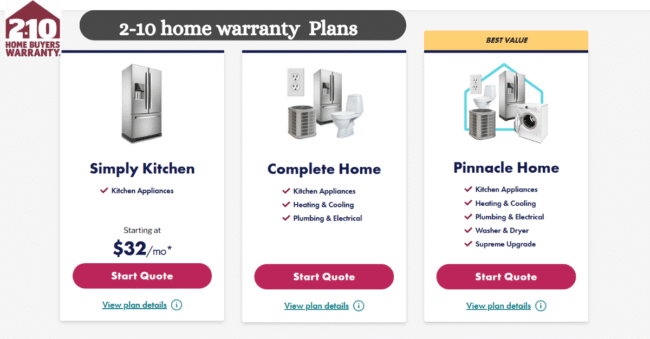

1) Selection of a Plan: Homeowners choose from tiers of coverage, such as basic, premium, or customizable plans with various optional add-ons.

2) Annual Premium Payment: After enrollment, a fee is paid annually. The amount is based on the home’s size, the state where it’s located, and the total amount of service.

3) Filing a Claim: When a covered item(s) breaks down, the homeowner files a claim—generally online or via a 24 hours a day/7 days a week customer service number.

4) Contractor Assignment: 2-10 assigns pre-vetted, licensed service providers who work in their network of reliable providers.

5) Service Fee: When the technician arrives at your home, the homeowner pays a flat service fee (generally $75–$125), regardless of the cost of the repair.

6) Repair or replacement: If the homeowner item is covered, the warranty pays for the repair or, if necessary, total replacement. This way, you do not have larger out-of-pocket surprises.

Cost Structure of a 2-10 Home Warranty (Detailed and Comprehensive)

When a homeowner understands what makes up the costs, they can allocate their budget even better.

Annual Plan Fee:

Annual fees for resale home warranties vary depending on how comprehensive a plan you are purchasing. Annual plan fees will generally range from $600, and a premium warranty may exceed $700 if any extra systems or high-quality appliances are included.

Service Call Fee:

A service call fee is charged and is generally a flat fee for each service request. You will typically pay $75–$125 for a service call regardless of the actual cost to repair or replace the item. Think of this as a deductible on each claim.

Add-On Options:

The exclusions from coverage are similar to auto insurance. For example, you can get extra coverage for well pumps, septic tanks, roof leak protection, and swimming pools; these can add $50–$250 per year depending on how comprehensive a plan is.

New Construction Warranties (Builder)

New construction warranties will vary in cost but are usually embedded into the home purchase price. New construction warranties also have a long-term structural protection period of up to 10 years.

In total, a homeowner may only pay up to $375–$850 annually, depending on the coverage they selected and the complexity of the home.

How to Choose the Right 2-10 Plan

Not all 2-10 plans are equal, and making the best choice is making sure protection matches your home’s specific situation.

There are a few key factors to consider:

System Age and Condition: Older HVAC or plumbing systems may need more comprehensive coverage, while newer homes may need more appliance-based plans.

Customization Availability: Some plans allow you to add coverage for things like smart home devices, extra fridges, and garage door openers. Choose what suits your home’s characteristics and equipment.

Service Fee Options: Some plans include lower service fees and higher annual premiums… or vice versa. Choose based on how frequently you expect to file claims.

Customer Reviews: Look at verified accounts of customer experiences related to claims, speed of contractors, and how issues are resolved. This allows you to avoid companies that fall short of your expectations related to support.

Network Size: A broad licensed contractor network ensures faster service and better quality service (particularly in emergencies).

Insurance plan 2-10 home warranty

Not the same thing. Home insurance covers perils like fire, theft, or weather damage. A 2-10 home warranty covers problems with tools and systems inside the house that happen because of normal wear and tear. Together they provide complete protection for the customer’s home.

How Long Does a 2-10 Warranty Last?

For resale homes:

Typical plans last 1 year, redeemable annually.

For new builds (builder coverage):

- 1 year for work

- Two years for subsystems

- 10 years for building

Undeniable Value—Peace of Mind During Inflation

With repair costs rising thanks to inflation, a warranty serves as a cost-containment mechanism. When HVAC parts are valued double at the supply store, you still pay only the flat service charge for the repair. This kind of peace of mind is generally overlooked until you realize parts costs, labor, and wait times go up too, just like the market creates other challenges.

What’s Not Covered in 2-10 home warranty?

A 2-10 warranty has exclusions. Most regular exclusions include:

Pre-existing damages

- Cosmetically incomplete items (scratches, dents)

- Improper installations

- Improperly maintained

- Outside items (unless additional coverage is added)

Comparison With Other Home warranties

2-10 Home Warranty offers strong system coverage, while Choice Home Warranty George Foreman is affordable but has mixed reviews. Choice Home Warranty includes free HVAC maintenance but higher fees, and select home warranty reviews are budget-friendly but have coverage limits.

Why Sellers Use 2-10 Warranties in Real Estate Deals

Home sellers add a 2-10 warranty to their home sale 99% of the time. Not only does it help build buyer confidence, but it is also another layer of assurance that can help sell a property faster by putting the buyer’s mind at ease about choices ‘they may not even think about’ when buying. It will also help protect the seller during marketing if something were to break before closing. You can also visit luxury villas italy le collectionist for property deals.

How Does the 2-10 Home Warranty Handle Emergencies?

Emergencies can’t wait—and this is where the 2-10 home warranty demonstrates its clear advantages. If your heat is out in the winter or your plumbing backs up late at night, the company has a 24/7 claim already submitted. Most emergency requests will be prioritized for same-day or next-day service. Standard claims will take the normal process and service hours; however, emergencies will move ahead of other claims. You will not have to scroll the internet or pay ridiculous after-hours fees. Some plans even contain emergency clauses that waive standard service fees for health- or safety-related issues.

How Important Are Home Inspections Before Obtaining a 2-10 Warranty?

Before entering into a 2-10 plan, completing a home inspection (more important for older homes) is a great idea. Why? Because the warranty does not cover pre-existing conditions, which will be hard to ascertain without professional help. Getting a home inspection provides you and the warranty provider with a record of the working condition of information and appliances before coverage begins. This will help eliminate disputes and potential denials of a claim. Additionally, it can help you select the best level of protection when considering the actual age of the system, current efficiency, and risk. It is a proactive step which will provide its value in the long run.

Do Landlords and Rental Property Owners Receive Value from 2-10 Warranties?

Yes. A 2-10 home warranty makes managing rental property much easier for landlords. Instead of dealing with emergency calls for maintenance and finding out if you have to perform the repair, the owner is able to put the repair responsibility into the warranty specialist’s hands. This makes the property ready to be occupied sooner, which creates tenant happiness and control around repair costs. For owners of multiple properties, some opt for a bulk plan or umbrella plan that covers the entirety of their portfolio. Some owners even include the service fees in a tenant lease as part of their “rental maintenance package”, making it easy for the repair process. It is good protection with a great professional benefit.

Ending

A 2-10 home warranty is not just a guarantee but rather a great decision in managing your home, providing you with options, preventing surprise repair bills, and reducing stress when your systems fail. With 24-hour claims processing, vetted contractors, and different coverage levels, the warranty represents a real-life commitment to the uncertainties we all face.

The key is getting the most from your warranty, which begins with understanding the fine print, customizing it based on the needs of your home, and utilizing it with a proactive, rather than a reactive, mindset. It is not just about fixing things after they break; it is about giving you peace of mind long-term.

For first-time buyers, longtime homeowners, and landlords, the 2-10 warranty is not just a contract but rather a reliable companion in the journey of homeownership.

Also Read:

Choice home warranty plans

Choice Home Warranty prices

Payday loans eloanwarehouse