Owning a property in the world’s largest tourism state, Florida is already a great advantage.

But being able to earn rental income from it, is the real cherry on top.

But in the short term vs long term rental debate, it’s crucial to understand which one is more profitable, particularly, if you are an owner.

Firstly, we need to explore what is considered a short term rental and how it compares to more extended agreements in Florida.

For this, let’s do a quick comparison by considering the routine struggles of owners from prominent cities of Florida, such as Miami, Orlando, Tampa, and, of course, Naples.

Short Term Rental vs Long Term Rental: Choices for Florida Owners

Choose Short Term Rentals if You:

- own a property in a city with a big number of tourists like Miami, Sarasota, or Orlando.

- want to earn massively, especially per night during peak seasons.

- don’t mind frequent guest turnover and active management

- are comfortable with low season income.

- have patients to handle higher maintenance costs and regular cleanups

- are okay to adhering strict local laws, licensing, and HOA rules in places like Naples or Miami Beach

Choose Long Term Rentals if You:

- want stable and reliable income every month.

- own property in cities like Jacksonville, Gainesville, or Tampa

- want low tenant turnover and fewer day-to-day responsibilities

- are looking for tenants who’ll stay 6+ months (possibly qualifying for homestead exemption)

- prefer lower maintenance costs and less frequent repairs

- value reliability over flexibility, especially during off-season or hurricane-prone months

What is a Short Term Rental Concept in Florida?

In Florida, the (STR) short term rentals are typically defined as, stays of 30 days or less, though some countries allow permit stays of up to 6 months. The concepts are mostly used in tourist cities.

Example:

In Miami, many property owners use platforms like Property Management Services in Florida to promote their rentals to weekend travelers.

It is a classic approach of short term rentals that Florida owners mostly use.

What is a Long Term Rental Concept in Florida?

(LTR) refer to Long term rentals, which are based on lease agreements that last over 6 months + 1 day (i.e., 183 days total); these total days qualify the agreement as long term under Florida law.

The extra one day is important in legal aspects, especially for owners in Homestead Exemption eligibility, as it refers to tax compensation/discount for Florida homeowners.

Example:

If we give a 3-bedroom home in Orlando to UCF students for a year, this counts as a standard Florida long term rental deal.

Short Term Rental vs Long Term Rental: Pros and Cons for Owners

STR Pros and Cons:

Advantages of Short Term Rental:

- Income in STR: Extreme income potential, especially when your property is near a tourist spot like Miami and Sarasota beach.

- Price Based on Preference: Changeable Pricing options, the owner can update the prices based on preference.

- Personal Usage: Flexibility for personal usage, block out dates when you want to stay.

- Tax Deduction: Some expenses, like marketing or furniture, are deductible if the property is dedicated to a business motive.

- Better Property Upkeep: Frequent maintenance makes property cleanup and furnishing a better aspect for occupants’ attention.

Disadvantages of Short Term Rental:

- More Guests, More Mess: Frequent guest turnover means more cleaning and upkeep, which further calls to the need of professional help.

- Strict Regulations: Local rules can be strict in some cities with heavy short term rental regulations. This includes cities like Miami Beach, Orlando, Fort Lauderdale, Palm Beach, and St. Augustine.

- Noise Complaints & Neighbor Issues: The owner needs to handle this situation, as short occupants usually stay for night house parties, which leads to noise issues and HOA complaints.

- Insurance Complexities: Homeowners insurance for short term rentals is more difficult to get in Florida.

LTR Pros and Cons:

Advantages of Long Term Rental:

- Consistent Income: Stable and reliable income that will consistently come until the agreement is finished.

- No Marketing: Don’t need to spend money on marketing, the long term rental contract usually remains 6 months or more than that.

- No Need for Cleaner: Less routine work, once set it and forget it until the new tenant does not visit for the deal.

- More Tenant Stability: Good tenants may renew the one-year contract if your property is in good condition to stay.

- Vacancies Rating: Lower vacancy rates, especially in college towns like Orlando or Gainesville.

Disadvantages of Long Term Rental:

- Toughest to Lose Problem: Problematic tenants are tougher to remove, because in LTR, the laws are pretty much in favour of tenants in comparison with landlords.

- Complication in Pricing: The owners can’t frequently change the rates as STR owners do. Well they can, but only if the contract is renewed or the tenants change.

- Property Wear-and-Tear Risk: Long-term occupants may not report issues instantly.

- Can’t Go with Market/Inflation: If the prices get high or inflation hits extremity, the owner will be locked into a long term lease.

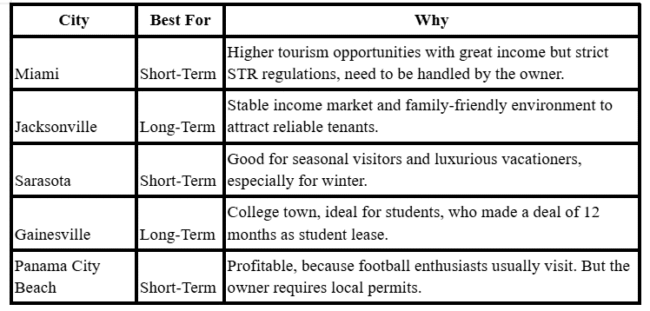

Where to Invest in Florida: Top Cities Rental Guide

Here is the prominent table that will assist you in proceeding with your rental journey and inform you of the benefits that you can avail, if you have the residency of one of these cities:

What are the Key Legal Requirements for Renting Out Property in Florida?

Licensing Requirements:

The native Florida owner should register their property while offering short term rental service with the Department of Business and Professional Regulation (DBPR).

Make sure that, during registration, a listing plan is defined within 30 days.

HOA and Local Restrictions:

Many Florida cities, including Naples, hold strict HOA or city-level rules limiting or banning short-term rentals.

Tourist Development Tax:

If you are a property owner in Florida and rent out your space for less than 6 months, as a landlord, you are required to collect and pay the state or county the amount as tourist development tax each month.

Lease Terms for Long-Term Rentals:

Long term rental requires a written contract which is based on Florida’s landlord-tenant laws for legal protection.

FAQ Section

Which is More Profitable in Florida, the Short Term or Long Term Rental?

Both plans have their own benefits. Short term rentals can gather higher incomes in tourist cities (Miami or Sarasota). On the other hand, Florida long term rentals will get steady and consistent income in cities (Jacksonville or Gainesville), which will be more reliable than STR.

Are there Legal Restrictions on Short Term Rentals in Florida Cities?

Yes, there are strict restrictions in cities like Naples, Miami Beach, and Orlando. Strict with the zoning laws, HOA restrictions, and requirements of specific licensing for operating short-term rentals.

What are the Key Factors to Consider When Choosing Between Short Term and Long Term Rentals in Florida?

Key considerations include location demand, seasonal tourism, property management needs, potential maintenance costs, and your own investment goals, whether you want flexibility or long term tenant assurance.

Can I Use My Florida Property for Both Short and Long Term Rentals?

Yes, many owners use a hybrid strategy, short term rentals in peak seasons and long term rentals during slower months. However, both approaches use conditions by considering the regulations of local zoning and HOA rules.

Conclusion:

In final thoughts, the decision between short term rental vs long term rental services in Florida all depends on lifestyle, time, goals, and the city you are investing in.

As an owner, if you want to earn an extensive income, the short term income is a great option, especially in peak tourism seasons in Miami and Sarasota, without doing any hustle or paperwork.

But you want to cut off the low season struggles. The long term rentals Florida services are a great option for you in Jacksonville or Gainesville, with income reliability, fewer management, and clean-up responsibilities.

At the end, after calculating all pros and cons of the rental venture, the income you will generate is based on the property you are offering to your client.